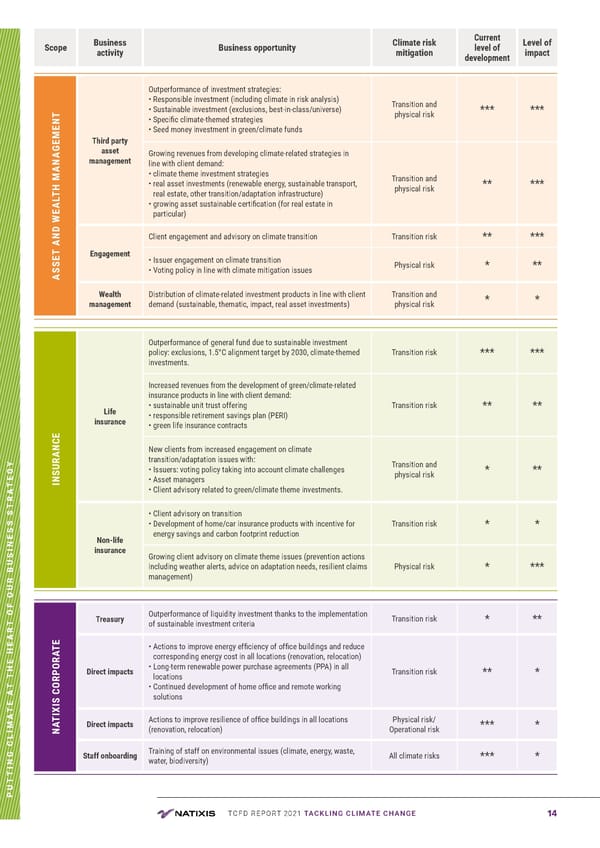

TCFD REPORT 2021 TACKLING CLIMATE CHANGE 14 PUTTING CLIMATE AT THE HEART OF OUR BUSINESS STRATEGY Scope Business activity Business opportunity Climate risk mitigation Current level of development Level of impact ASSET AND WEALTH MANAGEMENT Third party asset management Outperformance of investment strategies: • Responsible investment (including climate in risk analysis) • Sustainable investment (exclusions, best-in-class/universe) • Specific climate-themed strategies • Seed money investment in green/climate funds Transition and physical risk *** *** Growing revenues from developing climate-related strategies in line with client demand: • climate theme investment strategies • real asset investments (renewable energy, sustainable transport, real estate, other transition/adaptation infrastructure) • growing asset sustainable certification (for real estate in particular) Transition and physical risk ** *** Engagement Client engagement and advisory on climate transition Transition risk ** *** • Issuer engagement on climate transition • Voting policy in line with climate mitigation issues Physical risk * ** Wealth management Distribution of climate-related investment products in line with client demand (sustainable, thematic, impact, real asset investments) Transition and physical risk * * INSURANCE Life insurance Outperformance of general fund due to sustainable investment policy: exclusions, 1.5°C alignment target by 2030, climate-themed investments. Transition risk *** *** Increased revenues from the development of green/climate-related insurance products in line with client demand: • sustainable unit trust offering • responsible retirement savings plan (PERI) • green life insurance contracts Transition risk ** ** New clients from increased engagement on climate transition/adaptation issues with: • Issuers: voting policy taking into account climate challenges • Asset managers • Client advisory related to green/climate theme investments. Transition and physical risk * ** Non-life insurance • Client advisory on transition • Development of home/car insurance products with incentive for energy savings and carbon footprint reduction Transition risk * * Growing client advisory on climate theme issues (prevention actions including weather alerts, advice on adaptation needs, resilient claims management) Physical risk * *** NATIXIS CORPORATE Treasury Outperformance of liquidity investment thanks to the implementation of sustainable investment criteria Transition risk * ** Direct impacts • Actions to improve energy efficiency of office buildings and reduce corresponding energy cost in all locations (renovation, relocation) • Long-term renewable power purchase agreements (PPA) in all locations • Continued development of home office and remote working solutions Transition risk ** * Direct impacts Actions to improve resilience of office buildings in all locations (renovation, relocation) Physical risk/ Operational risk *** * Staff onboarding Training of staff on environmental issues (climate, energy, waste, water, biodiversity) All climate risks *** *

TCFD Report | Nataxis Page 13 Page 15

TCFD Report | Nataxis Page 13 Page 15