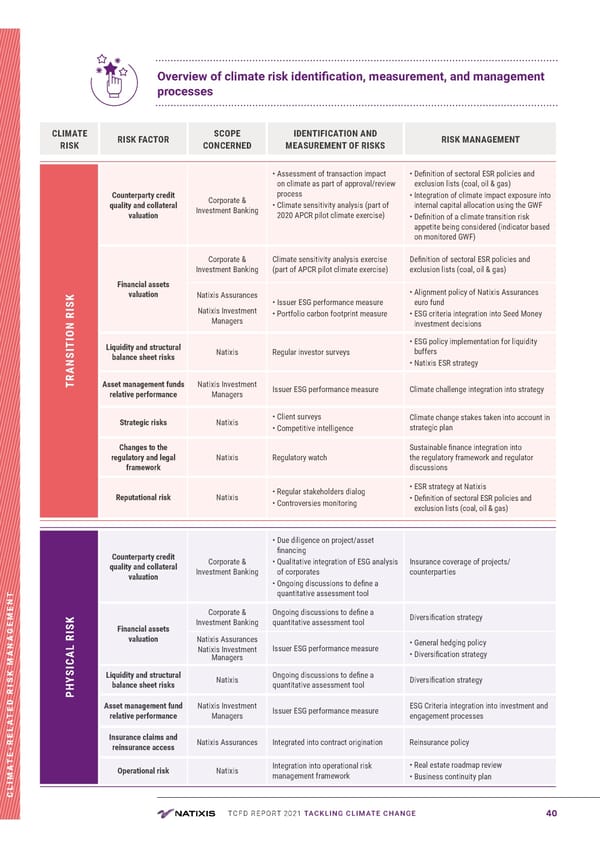

TCFD REPORT 2021 TACKLING CLIMATE CHANGE 40 CLIMATE-RELATED RISK MANAGEMENT CLIMATE RISK RISK FACTOR SCOPE CONCERNED IDENTIFICATION AND MEASUREMENT OF RISKS RISK MANAGEMENT TRANSITION RISK Counterparty credit quality and collateral valuation Corporate & Investment Banking • Assessment of transaction impact on climate as part of approval/review process • Climate sensitivity analysis (part of 2020 APCR pilot climate exercise) • Definition of sectoral ESR policies and exclusion lists (coal, oil & gas) • Integration of climate impact exposure into internal capital allocation using the GWF • Definition of a climate transition risk appetite being considered (indicator based on monitored GWF) Financial assets valuation Corporate & Investment Banking Climate sensitivity analysis exercise (part of APCR pilot climate exercise) Definition of sectoral ESR policies and exclusion lists (coal, oil & gas) Natixis Assurances Natixis Investment Managers • Issuer ESG performance measure • Portfolio carbon footprint measure • Alignment policy of Natixis Assurances euro fund • ESG criteria integration into Seed Money investment decisions Liquidity and structural balance sheet risks Natixis Regular investor surveys • ESG policy implementation for liquidity buffers • Natixis ESR strategy Asset management funds relative performance Natixis Investment Managers Issuer ESG performance measure Climate challenge integration into strategy Strategic risks Natixis • Client surveys • Competitive intelligence Climate change stakes taken into account in strategic plan Changes to the regulatory and legal framework Natixis Regulatory watch Sustainable finance integration into the regulatory framework and regulator discussions Reputational risk Natixis • Regular stakeholders dialog • Controversies monitoring • ESR strategy at Natixis • Definition of sectoral ESR policies and exclusion lists (coal, oil & gas) PHYSICAL RISK Counterparty credit quality and collateral valuation Corporate & Investment Banking • Due diligence on project/asset financing • Qualitative integration of ESG analysis of corporates • Ongoing discussions to define a quantitative assessment tool Insurance coverage of projects/ counterparties Financial assets valuation Corporate & Investment Banking Ongoing discussions to define a quantitative assessment tool Diversification strategy Natixis Assurances Natixis Investment Managers Issuer ESG performance measure • General hedging policy • Diversification strategy Liquidity and structural balance sheet risks Natixis Ongoing discussions to define a quantitative assessment tool Diversification strategy Asset management fund relative performance Natixis Investment Managers Issuer ESG performance measure ESG Criteria integration into investment and engagement processes Insurance claims and reinsurance access Natixis Assurances Integrated into contract origination Reinsurance policy Operational risk Natixis Integration into operational risk management framework • Real estate roadmap review • Business continuity plan Overview of climate risk identification, measurement, and management processes

TCFD Report | Nataxis Page 39 Page 41

TCFD Report | Nataxis Page 39 Page 41