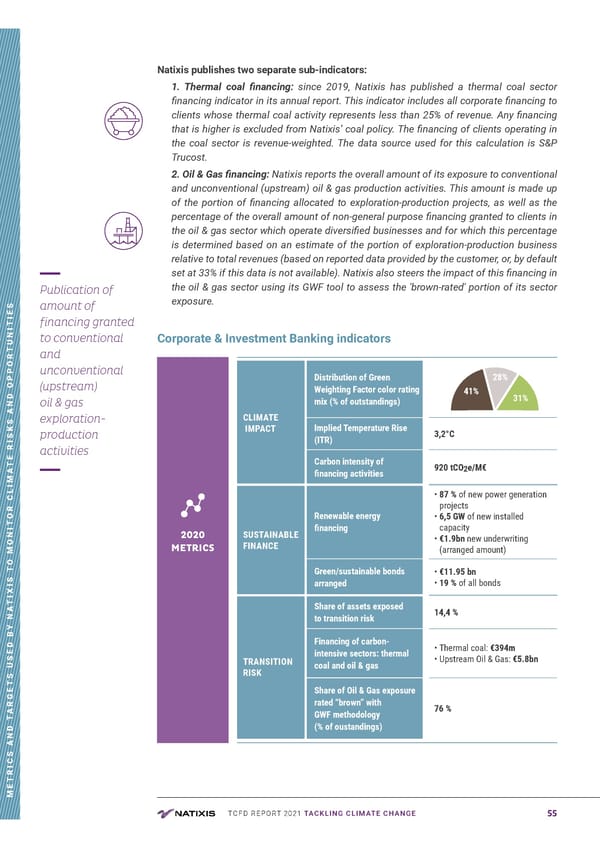

TCFD REPORT 2021 TACKLING CLIMATE CHANGE 55 METRICS AND TARGETS USED BY NATIXIS TO MONITOR CLIMATE RISKS AND OPPORTUNITIES Natixis publishes two separate sub-indicators: 1. Thermal coal financing: since 2019, Natixis has published a thermal coal sector financing indicator in its annual report. This indicator includes all corporate financing to clients whose thermal coal activity represents less than 25% of revenue. Any financing that is higher is excluded from Natixis’ coal policy. The financing of clients operating in the coal sector is revenue-weighted. The data source used for this calculation is S&P Trucost. 2. Oil & Gas financing: Natixis reports the overall amount of its exposure to conventional and unconventional (upstream) oil & gas production activities. This amount is made up of the portion of financing allocated to exploration-production projects, as well as the percentage of the overall amount of non-general purpose financing granted to clients in the oil & gas sector which operate diversified businesses and for which this percentage is determined based on an estimate of the portion of exploration-production business relative to total revenues (based on reported data provided by the customer, or, by default set at 33% if this data is not available). Natixis also steers the impact of this financing in the oil & gas sector using its GWF tool to assess the 'brown-rated' portion of its sector exposure. Corporate & Investment Banking indicators CLIMATE IMPACT Distribution of Green Weighting Factor color rating mix (% of outstandings) Implied Temperature Rise (ITR) 3,2°C Carbon intensity of financing activities 920 tCO 2 e/M€ SUSTAINABLE FINANCE Renewable energy financing • 87 % of new power generation projects • 6,5 GW of new installed capacity • €1.9bn new underwriting (arranged amount) Green/sustainable bonds arranged • €11.95 bn • 19 % of all bonds TRANSITION RISK Share of assets exposed to transition risk 14,4 % Financing of carbon- intensive sectors: thermal coal and oil & gas • Thermal coal: €394m • Upstream Oil & Gas: €5.8bn Share of Oil & Gas exposure rated “brown” with GWF methodology (% of oustandings) 76 % Publication of amount of financing granted to conventional and unconventional (upstream) oil & gas exploration- production activities 2020 METRICS 27 % 41 % 52% 31% 21 % 38 % 41% 31% 28%

TCFD Report | Nataxis Page 54 Page 56

TCFD Report | Nataxis Page 54 Page 56